*

http://www.proprofs.com/flashcards/story.php?title=coreanglish-literacy

Reading Korean Consonants and Vowels using this homemade A-Z Chart!

- 1In order to read Korean Consonants and Vowels; start by organizing Korean Consonants and Vowels in corresponding A-Z.

Phonetically "A" in Korean is usally "AH" Sounding. ㅍ P ㅕ(Yuh)yeo ㅇng ( aka Puh-ng) Chㅊ aㅏ(ah) ng (ㅇ= ng) (aka Chah ng) =

평창

- 2A-Z Chart listing corresponding Korean Consonants and Vowels :: Coreanglish A-Z : FlashCardDatadefinitionsymbolsㅐ,ㅏ,ㅓ, ㅔAㅂBㅋ,ㅊCㄷDㅇ, ㅣ, ㅔ, ㅐEscrape lower lip with front teeth (no F in K-Alphabet)Fㄱ, ㅈGㅎHㅇ, ㅣ, ㅏㅣ,ㅓIㅈJㅋK애오 러어 ㅗ ㅛLㅁMㄴNㅗ ㅓ ㅏOㅍ ㅃPㅋQㄹ 아알 뤄 얼 열Rㅅ ㅆSㅌ ㄷTㅠ ㅜ ㅛ ㅓUScrape front teeth and bottom lipV더블유우 = ㅝW익ㅅ ㅈX이이 이 ㅛYVibrate G sound while top and bottom teeth are clenchedZㅂ ㄷ ㅈ ㄱ ㅃ ㄸ ㅉ ㄲ ㅍ ㅌ ㅊ ㅋ ㅅ ㅎ ㅆ ㅁ ㄴ ㅇ ㄹ19 K Consonantsㅣ ㅔ ㅚ ㅐ ㅏ ㅗ ㅜ ㅓ ㅡ ㅢ ㅖ ㅒ ㅑ ㅛ ㅠ ㅕ ㅟ ㅞ ㅙ ㅘ ㅝ21 K vowels

- 3A = makes the Korean sounds; Ah+ EE = eh, Ah, Uh, Uh+ee=EHㅐ,ㅏ,ㅓ, ㅔA

- 4B= makes the Korean Sound "Beuh"ㅂB

- 5C= makes the Korean Sounds "Keuh" and "CH"ㅋ,ㅊC

- 6D= makes the Korean sound "deuh" as in D sound in Door. ㄷD

- 7E= makes sounds; "ng", "E", "Uh+Ee=eh", "Ah+ee=Eh"ㅇ, ㅣ, ㅔ, ㅐE

- 8scrape lower lip with front teeth (no F in K-Alphabet)F

- 9G= makes "G" in Girl and "Ge" in George.ㄱ, ㅈG

- 10H= makes the "H" sound in Hat.ㅎH

- 11i = makes sounds; "ng", "ee", "ah-ee", "uh"ㅇ, ㅣ, ㅏㅣ,ㅓI

- 12J=makes "J" in "Jesus"ㅈJ

- 13K= makes the "K" sound in "Kramer"ㅋK

- 14L = makes sounds; "Eh-Oh", "Luh-UH", "Oh", and "Yoh"애오 러어 ㅗ ㅛL

- 15M= ㅁ= makes the sound "M" as in "Mouth"

- 16N = makes the sound "N" as in Noseㄴ

- 17Letter O makes three Korean Sounds; (ㅗ as in Oh) , (ㅓ as in uh) , (ㅏ as in AH)

- 18ㅍ as in "P" of Pizza, ㅃ as in "accented Omlout double sound uniquely in Korean Vocab for the word ,Kissing, "Phoh-Phoh".

- 19Q makes the sound ,ㅋ, as in "K" sound.

- 20ㄹ as in R of Robot, 아알 as Ah-Are, 뤄 as in Ruh, 얼 as in Uh-UhLR, 열 as in YUH-UH-UHLR

- 21ㅅ as in School, ㅆ as in Sun.

- 22ㅌ as in T of Toy, ㄷ as in TH of The

- 23U makes the sounds;ㅠ as in U, ㅜ as in OOH, ㅛ as in YOH, ㅓas in UH

- 24Scrape front teeth and bottom lipV

- 25W makes the sounds ; 더블유우 as in DUH-V-YOO, ㅝ as in WUH

- 26X makes the sounds; "익ㅅ as in EEHK-S" , "ㅈ as in J in Juice"

- 27Y makes the sounds; 이이 long ee, 이 short e , ㅛ yoh.

- 28There's no Korean Consonant nor Vowel to spell English "Z"; Vibrate G sound while top and bottom teeth are clenched

- 29ㅂ ㄷ ㅈ ㄱ ㅃ ㄸ ㅉ ㄲ ㅍ ㅌ ㅊ ㅋ ㅅ ㅎ ㅆ ㅁ ㄴ ㅇ ㄹ19 K Consonants

- 3021 Korean VOWELS; ㅣ ㅔ ㅚ ㅐ ㅏ ㅗ ㅜ ㅓ ㅡ ㅢ ㅖ ㅒ ㅑ ㅛ ㅠ ㅕ ㅟ ㅞ ㅙ ㅘ ㅝ

- 31Snow – S in snow is not accented (School)ㅅ

- 32Sun ( Accented Double S)ㅆ

- 33Ph^oh – Ph^oh (aka Kiss) Pororo the Penguinㅃ

- 34Theu^h -Guh-Wuh-Yoh ( aka It’s Hot!)ㄸ

- 35Zhee^t^-Juh-Yoh ( aka Rip it!)ㅉ

- 36Khah^ng-Tohng ( Aluminum Can)ㄲ 까

- 37ㅊ ( used as Consonant sound of CH in CHew)ch

- 38ㅇ (if used as Consonant always in order 3)ng

- 39넓 r +b ( two letters combined to make the Consonant Sound in Order 3 )rb ( Sample of 4; 넓), N, Uh, R B.

- 40읽 r+g ( two letters combined to make the ONE Harmonious Consonant sound in Order 3)rg

- 41ㅇ (if used as CONSONANT placed in Order 1 that makes VOWEL sounds of 3 letters e in Cheese + y in shiny + i of IN )i

- 42Korean Characters are placed in minimum of TWO (ex 나 ) and maximum of # ? (ex 옴 ) placements to create a word; 옴 ( ㅇ ) ‘letter O’ is the Consonant on Order 1 ( ㅗ ) is a vowel sound ‘oh’ in Order 2b ( ㅁ) is the supporting Consonant in Order 3 ( # ? characters combined makes the ONE Harmonious Flat Sound ‘ Ohm’ ) order 1 + order 2b + order 3three (옴; i, oh, m)

- 43나 ( ㄴ) is the N sound of a Consonant placed on order1 and (ㅏ ) is the Ah sound of a Vowel in order 2a ( # ? characters combined make the one Flat Sound ‘NAH’ ) order 1 + order 2atwo

- 44ㅣee

- 45ㅔ as in "UH+EE=EH" ( same sound as ㅐ aka Ah+Ee=Eh )Eh

- 46ㅚ as in "Oh+EE=WEH"weh

- 47ㅐ ( same sound as ㅔ )Eh

- 48ㅏAh

- 49ㅗOh

- 50ㅜWoo

- 51ㅓuh

- 52ㅡ ( grunting sound made when punched on the tummy)euh

- 53ㅢ ( makes similar sounds euh or euhee )euhee

- 54yehㅖ as in YUH+EE=YEH or ㅒas in YAH+EE=YEH

- 55wuhㅝ

- 56yahㅑ

- 57yoㅛ

- 58youㅠ

- 59yuhㅕ

- 60wieㅟ

- 61wehㅞ

- 62wAhㅘ

- 63J, / Geoㅈ

- 64Schoolㅅ ㄲ ㅜ ㅜ ㅗ

- 65Dayㄷ,애애,이이

- 66Toyㅌ,ㅗ,이 이

- 67Topㅌ,ㅏ,ㅍ

- 68EnglishReading language BunJee Jump modeled Sounds 1.up slow 2. Hold on top 3 Drops quickly to swing in mid air without hitting the ground – do not drop the last syllableKoreanReading ? language Sounds are FLAT and drops down at end

- 69Twirledㅌ,ㅝ,ㅓㄹ,ㅗ,*,ㄷ (note; * means ‘ no sound ‘)

- 70KoreanReading Korean language Sounds are FLAT and drops down at end

- 71Umbrellaㅓ,ㅁ,ㅂ,뤄,ㅐ,ㅗ,러,ㅏ

- 72VaseV,애 애,ㅆ , * (note; * means ‘ no sound ‘)

- 73Wineㅝ,아이,ㄴ, * (note; * means ‘ no sound ‘)

- 74adultsㅓ,ㄷ,ㅓ,ㅗ, (ㅌ silent 't') ,ㅅ

- 75walkㅝ,ㅓ,ㅗ,ㅋ

- 76xylophoneㅈ,ㅏ ㅣ,러,ㅓ,PH, ㅗ,ㄴ, * (note; * means ‘ no sound ‘)

- 77greatㄱ,뤄,애 애,ㅌ

- 78instrumentㅣ,ㄴ,ㅅ,ㅊ,뤄,ㅓ,ㅁ,ㅐ,ㄴ,ㅌ

- 79yellow이,ㅐ,ㅗ,러,ㅗ,ㅜ

- 80zorro“ㅈ”,ㅗ,ㅓㄹ ,뤄,ㅗ ( Character “ㅈ”-Clench teeth and vibrate letter G to get letter “Z” sound )

- 81Bridge- ㅂ (*뤄 ,ㅣ*) ㄷ ㅈ =(ㅂ, *뤼*, ㄷ, ㅈ) THIS is ??? Pronunciation Native English Pronunciation

- 82Bridge pronunciation; First part ( go up slowly and increase the sounds) ㅂ-뤼 Second part (hold the sound) ㄷ Third part ( drop the sound quickly, but swing it upward) ㅈ

- 83Pronunciation Konglish Pronunciation= Bridge= 브릿지 in Korean Native Pronunciation sounds "B-Rit-Jee"; While in English Sounds "B-RID-GEE" where B climbs up to "RID" and drops half way to "GEE".

- 84dayㄷ,애애,이이

- 85toyㅌ,ㅗ,이 이

- 86topㅌ,ㅏ,ㅍ

- 87walkㅝ,ㅓ,ㅗ,ㅋ

- 88umbrellaㅓ,ㅁ,ㅂ,뤄,ㅐ,ㅗ,러,ㅏ

한국수화 KOREAN SIGN LANGUAGE

바이칼 호수 http://terms.naver.com/entry.nhn?docId=1837134&cid=43667&categoryId=43667

CURRENT DIVERSE WORLD Religious Services Held on KOREAN PENINSULA since WW1

| Protestant |

Ansan Bugok Presbyterian Church

Worship with English interpretation every Sunday morning at 11:00 and evening at 7:30 p.m. followed by fellowship among foreign and English-speaking Korean members.

Worship with English interpretation every Sunday morning at 11:00 and evening at 7:30 p.m. followed by fellowship among foreign and English-speaking Korean members.

Int'l Lutheran Church, Seoul, Korea 726-39, Hannam 2-dong, Yongsan-gu, Seoul 140-212

(downtown Seoul near Chungbu Police Station) International Worship in English (IWE) has three services each week. Sunday at 10:00 AM (Service Building rm 504) and 3:00 PM (Mission Chapel) as well as Wednesday 8:00 PM

Yoido Full Gospel Church

Senior Pastor: Dr. Yonggi Cho. Service with simultaneous interpretation in English at 7 a.m., 11 a.m. and 1 p.m. Japanese and Chinese interpretation also provided at 9 and 11 a.m.

Senior Pastor: Dr. Yonggi Cho. Service with simultaneous interpretation in English at 7 a.m., 11 a.m. and 1 p.m. Japanese and Chinese interpretation also provided at 9 and 11 a.m.

Yongsan Baptist Church

Sunday school at 9:45 a.m. and English-language worship service at 11 a.m. and 6 p.m. Nursery care available. Located near the Crown Hotel in Yongsan. Pastor Bill Ecton

Sunday school at 9:45 a.m. and English-language worship service at 11 a.m. and 6 p.m. Nursery care available. Located near the Crown Hotel in Yongsan. Pastor Bill Ecton

Seoul International Baptist Church (SIBC)

We are an English speaking church providing encouragement, Christian fellowship, and an emphasis on a real and growing relationship with God through His Son, Jesus. We believe that the Bible is God's Word and provides direction, advice, and strength for living. Come join us as together we discover God's great plans for each of our lives. Our worship service time is, Sunday at 11AM. Senior pastor is Dr. Dan Armistead.

We are an English speaking church providing encouragement, Christian fellowship, and an emphasis on a real and growing relationship with God through His Son, Jesus. We believe that the Bible is God's Word and provides direction, advice, and strength for living. Come join us as together we discover God's great plans for each of our lives. Our worship service time is, Sunday at 11AM. Senior pastor is Dr. Dan Armistead.

English Sunday service at 11:20am in Westminster Hall, and Friday Bible study at 7:00pm in Rm 603. The church is easily accessible: by subway, Daechi station (line 3), or by taxi (across from well-known Eunma Apt). Led by Rev. Joshua Cho (expat Korean-American)

Worship with the English-speaking community: 9:30 a.m. Sunday school for all ages at 11 a.m. Located in Foreigner's Cemetery Park, north of the Yanghwa Bridge. An evangelical and international church. Rev. Prince Charles.

Somang Presbyterian Church

English-language worship service "Voice of Hope" at 2 p.m. Sundays. English sunday school from 12:45 p.m. to 1:45 p.m. at basement 3-1 of Missionary Hall. Preacher, pastor Robert von Oeyen. Located in Shinsa-dong, Kangnam-gu.

English-language worship service "Voice of Hope" at 2 p.m. Sundays. English sunday school from 12:45 p.m. to 1:45 p.m. at basement 3-1 of Missionary Hall. Preacher, pastor Robert von Oeyen. Located in Shinsa-dong, Kangnam-gu.

Onnuri English Ministry at Yangjae

Make us your home church away from home. 11 a.m. Service at the Onnuri Church Yangjae campus at Yangjae-dong 55, Seocho-gu, near Yangjae station (Line 3). Baby-sitting and Children's Sunday School provided. Pastor Leo Rhee

Make us your home church away from home. 11 a.m. Service at the Onnuri Church Yangjae campus at Yangjae-dong 55, Seocho-gu, near Yangjae station (Line 3). Baby-sitting and Children's Sunday School provided. Pastor Leo Rhee

Daeduk Hanbit Presbyterian Church

English Worship Service every Sunday at 12:15 p.m.

English Worship Service every Sunday at 12:15 p.m.

Christ Freedom Assembly Seoul

(Pentecostal Int'l Church) Worship with us and experience God's transformation. English worship service: Sunday 10 a.m Wednesday 7:30 p.m: Bible Study Friday 8:30 p.m: Prayer Meeting with Rev. Bill O Joshua Ph.D Itaewon-dong 36-23 Behind Crown Hotel

(Pentecostal Int'l Church) Worship with us and experience God's transformation. English worship service: Sunday 10 a.m Wednesday 7:30 p.m: Bible Study Friday 8:30 p.m: Prayer Meeting with Rev. Bill O Joshua Ph.D Itaewon-dong 36-23 Behind Crown Hotel

Yongsan Chapel Community

Mass at Memorial Chapel at 5 p.m. Saturdays and noon Sundays. South Post Chapel Mass at 9 a.m. and Catholic religious education at 10 a.m. Sundays. Just a note that Mass times on post have changed. Mass on Sunday at South Post chapel is at 8 a.m. with religious education at 9:30 a.m.

Itaewon International Church

Contemporary Christian worship services in English language are available for all foreigners. Mass in English at 8 p.m Thursdays. The Church is located in Itaewon on Bogwangdong-gil. Call Pastor Roger Kim

Contemporary Christian worship services in English language are available for all foreigners. Mass in English at 8 p.m Thursdays. The Church is located in Itaewon on Bogwangdong-gil. Call Pastor Roger Kim

Iyewon Church

Mass in English at 3 p.m. Sundays. The Church is located in Deungchon-Dong, Gangseo-Gu. Call Ju, Dong Ho

Mass in English at 3 p.m. Sundays. The Church is located in Deungchon-Dong, Gangseo-Gu. Call Ju, Dong Ho

Shinil Church

2:00 p.m. Sunday English worship service with fellowship

4:00 p.m. Sunday Bible Study

8:00 p.m. Wednesday night praise and prayer

7:30 p.m. Friday night get together

Located by Yaksu station on lines 3 & 6, exit 3, turn right at Hana Bank.

Contact: Pastor Terry Cobban

2:00 p.m. Sunday English worship service with fellowship

4:00 p.m. Sunday Bible Study

8:00 p.m. Wednesday night praise and prayer

7:30 p.m. Friday night get together

Located by Yaksu station on lines 3 & 6, exit 3, turn right at Hana Bank.

Contact: Pastor Terry Cobban

Seventh-Day Adventist

English language service at SDA Language Institute in the Seoul Adventist Hospital compound Saturdays at 9:30 a.m. (Sabbath School) and 11 a.m. (church service).Service is also provided at the 121st Evacuation Hospital Chapel in Yongsan.

English language service at SDA Language Institute in the Seoul Adventist Hospital compound Saturdays at 9:30 a.m. (Sabbath School) and 11 a.m. (church service).Service is also provided at the 121st Evacuation Hospital Chapel in Yongsan.

Church of Jesus Christ of Latter Day Saints

English-language worship service at the Cheongwoon-dong chapel near the Chahamun Tunnel commencing with sacrament meeting at 12:30 p.m. Call Corey Turner

English-language worship service at the Cheongwoon-dong chapel near the Chahamun Tunnel commencing with sacrament meeting at 12:30 p.m. Call Corey Turner

The Community of JOY (in Daejeon City)

Our ministry is to the English speaking persons living in Daejeon Metropolitan City and surrounding areas. Our Sunday morning worship begins at 10 a.m. in the Siloam Center (Chung Nam First Methodist Church.) The style of worship is contemporary. Immediately following the worship, we have a time of refreshment & Adult Bible study follows. We are located in Tanbang-dong, Seo-gu -- situated less than a kilometer from the Lotte Department Store. For more information, call the church office

Our ministry is to the English speaking persons living in Daejeon Metropolitan City and surrounding areas. Our Sunday morning worship begins at 10 a.m. in the Siloam Center (Chung Nam First Methodist Church.) The style of worship is contemporary. Immediately following the worship, we have a time of refreshment & Adult Bible study follows. We are located in Tanbang-dong, Seo-gu -- situated less than a kilometer from the Lotte Department Store. For more information, call the church office

WORD OF LIFE INTERNATIONAL FELLOWSHIP(in Incheon City)

Inter-denominational English language church for the international community in Incheon. Sunday services at 4.30pm in Jooan Methodist Church near to Jooan Station. Led by Pastor Stuart Read

Inter-denominational English language church for the international community in Incheon. Sunday services at 4.30pm in Jooan Methodist Church near to Jooan Station. Led by Pastor Stuart Read

Worldwide Community Church

Location: Sam San Chil Dan Ji, Bupyeong Gu, Inchoen, close to Seoul and Bucheon. We welcome everyone to our English language service at 2:00 PM on Sundays. Everyone here is very friendly, and we want to meet you! Please visit our website for more info including directions

Location: Sam San Chil Dan Ji, Bupyeong Gu, Inchoen, close to Seoul and Bucheon. We welcome everyone to our English language service at 2:00 PM on Sundays. Everyone here is very friendly, and we want to meet you! Please visit our website for more info including directions

| Roman Catholic |

Myongdong Cathedral

Weekday Mass in Korean at 6:30, 7 a.m. and 6, 6:30 p.m., Sunday Mass at 7, 9, 10 and 11 a.m., preceeded by confession in English.

Weekday Mass in Korean at 6:30, 7 a.m. and 6, 6:30 p.m., Sunday Mass at 7, 9, 10 and 11 a.m., preceeded by confession in English.

Seodaemun Catholic Church

English Mass at 12:00 noon every Sunday. Seodaemun Catholic Church is located two blocks from Seodaemun Subway Station (line number 5) exit 2.

English Mass at 12:00 noon every Sunday. Seodaemun Catholic Church is located two blocks from Seodaemun Subway Station (line number 5) exit 2.

Hyewha-dong Catholic Church

Tagalog Mass every Sunday at 1:30 p.m. for Filipinos.

Tagalog Mass every Sunday at 1:30 p.m. for Filipinos.

Catholic International Parish of Seoul

Celebrates Mass in the Franciscan Chapel at Hannam-dong across from Hannam Village Apts. Pastor Vipporio Di Nardo and the entire parish community welcome you to attend our weekly celebrations. English Mass by Father Paolo Sundays at 9 and 11 a.m.; French Mass by Father Durand Saturdays at 6 p.m.; German Mass by Father Wilhelm Schulte sundays at 10 a.m.; and Italian/Spanish Mass Sundays at 11 a.m.

Celebrates Mass in the Franciscan Chapel at Hannam-dong across from Hannam Village Apts. Pastor Vipporio Di Nardo and the entire parish community welcome you to attend our weekly celebrations. English Mass by Father Paolo Sundays at 9 and 11 a.m.; French Mass by Father Durand Saturdays at 6 p.m.; German Mass by Father Wilhelm Schulte sundays at 10 a.m.; and Italian/Spanish Mass Sundays at 11 a.m.

Songbuk-dong Church

English Mass every Sunday at 10 a.m. H.O Choi

English Mass every Sunday at 10 a.m. H.O Choi

Yongsan Chapel Community

Mass at Memorial Chapel5 p.m. Saturdays and noon Sundays. South Post Chapel Mass at 9 a.m. and Catholic religious education at 10 a.m. Sundays.Just a note that Mass times on post have changed. Mass on Sunday at South Post chapel is at 8am with religious education at 9:30am

Mass at Memorial Chapel5 p.m. Saturdays and noon Sundays. South Post Chapel Mass at 9 a.m. and Catholic religious education at 10 a.m. Sundays.Just a note that Mass times on post have changed. Mass on Sunday at South Post chapel is at 8am with religious education at 9:30am

Inchon Catholic International Community

English Mass at 4 p.m. Sundays by Father Raymond T. Sabio at the Inchon Cathedral in Tap-dong, Inchon. Everyone welcomed.

English Mass at 4 p.m. Sundays by Father Raymond T. Sabio at the Inchon Cathedral in Tap-dong, Inchon. Everyone welcomed.

Ansan Won-gok Church

English and Tagalog Mass at 3 p.m. Ilkun's House

English and Tagalog Mass at 3 p.m. Ilkun's House

Suwon Godeung-dong Church

English Mass at 4:30 p.m. for foreign workers. People of all nationalities are welcome.

English Mass at 4:30 p.m. for foreign workers. People of all nationalities are welcome.

Songnam Songnam-dong Church

Mass for foreign workers at 12:30 p.m.

Mass for foreign workers at 12:30 p.m.

| Orthodox Church |

Orthodox Church in Korea

St.Nicholas Cathedral in Ahyon-Dong, Mapo, Seoul, Sundays and Feasts, Divine Liturgy in Korean at 10 a.m. St. Maxim Chapel, Divine Liturgy in Slavonic, 1st and 3rd Sunday, at 10 a.m.; 2nd Sunday in English, 4th Sunday in Greek.

St.Nicholas Cathedral in Ahyon-Dong, Mapo, Seoul, Sundays and Feasts, Divine Liturgy in Korean at 10 a.m. St. Maxim Chapel, Divine Liturgy in Slavonic, 1st and 3rd Sunday, at 10 a.m.; 2nd Sunday in English, 4th Sunday in Greek.

Annunciation Orthodox Church

Located in Taechong-dong, Chung-gu, Pusan Divine Liturgy, at 10 a.m. Sundays and vespers at 5 p.m. Saturdays.

Located in Taechong-dong, Chung-gu, Pusan Divine Liturgy, at 10 a.m. Sundays and vespers at 5 p.m. Saturdays.

| Jewish |

Jewish Services of EUSA

On the South Post of the Eighth U.S. Army base in Yongsan, in the Jewish Activities Center Building 4100, Fridays at 7:30 p.m. and Saturdays at 9:30 a.m. Larry Rosenberg

On the South Post of the Eighth U.S. Army base in Yongsan, in the Jewish Activities Center Building 4100, Fridays at 7:30 p.m. and Saturdays at 9:30 a.m. Larry Rosenberg

| Buddhist |

The Guiding Zen Master of Jungto Society Ven. Pomnyun Sunim is the founder and Guiding Zen Master of Jungto Society. He entered Buddhist Sangha as a novice guided by his teacher, Ven. Bulshim Domoon Sunim, at Boonwhangsa Temple, South Korea, in 1969, and was ordained a bhikku by his teacher in 1991. He is not only a Buddhist monk and Zen master but also a social activist who leads various movements such as ecological awareness campaign; promotion of human rights and world peace; and eradication of famine, disease, and illiteracy. Venerable Pomnyun Sunim, a respected Buddhist monk and activist, began humanitarian assistance to North Korea immediately after the 1995 flood when the famine situation arose in 1995 and had published reports on the ‘North Korean Food Crisis’, ‘North Korean Refugees Situation’ and the ‘Comprehensive Reports on the Human Rights Issues in North Korea’. He is the chairman of The Peace Foundation in Seoul, which supports policy research and analysis aimed at Korean unification and humanitarian issues in North Korea. He concurrently serves as the chairman of Good Friends for Peace, Human Rights, and Refugee Issues, whose weekly publication “North Korea Today” provides detailed, up-to-date information about conditions on the ground in North Korea. Venerable Pomnyun is also chairman of the Join Together Society, an international relief agency with offices worldwide, including in North Korea. He has worked extensively to supply humanitarian aid to famine victims in North Korea and defend the human rights of North Korean refugees in China. He is also a Zen master with the Seoul-based JungTo Society, which he originally established in 1988 to facilitate self-improvement through volunteerism. Jungto Society’s motto is ‘Open Mind, Good Friends, and Clean Earth.’ Ven. Pomnyun Sunim has been advocating a new paradigm of civilization movement in which everyone is happy through practice, creates a happy society through active participation in social movements, and protects our environment and the Earth, the mother of all living things, through a simple life style. As part of the new paradigm movement, he founded Join Together Society in 1994 to eradicate famine in developing countries; Eco Buddha in 1994 to protect the environment; and Good Friends in 1999 to advocate human rights, help refugees, and promote world peace. He also established The Peace Foundation, a private research institute, in 2004, to bring permanent peace, stability, and unification to the Korean Peninsula. Through these organizations, he has devoted himself to advocating human rights, eradicating famine, disease, and illiteracy in many countries (Afghanistan, India, Mongolia, Myanmar, Philippines, Sri Lanka, and North Korea) and promoting peace on the Korean Peninsula. In recognition of his efforts to promote peace and human rights, the Ramon Magsaysay Award for Peace and International Understanding was granted to Ven. Pomnyun Sunim in September 2002. Ven. Pomnyun Sunim’s easy, clear, and insightful advice based on Buddha’s teachings shows us how to be happy and free in our daily life. His books and Dharma talks available in audio cassettes, CDs, video files on the website, and DVDs have had great appeal to many people.

Books (Korean) The Way to the Unification of the Korean Peninsula / The Harmony of Work and Buddhist Practice/ Looking for Happiness in the World – In Search of a Hopeful Paradigm for Society / New Leadership for Future Generation / Buddhism and Peace / Buddhism and Environment / Commentaries I and II on the Diamond Sutra / Commentary on the Heart Sutra / The Frog Jumped Out of a Well / A Treatise for Young Buddhist Practitioners / Buddha–The Life and Philosophy / Engaged Buddhism / Eastern Philosophy and Environmental Issues/ It’s OK to Make Mistakes / Wisdom for Marriage / Wisdom for Mothers / Buddha – The Life and Philosophy / Prayer / The New Century / Enlightenment/ Lecture on The Diamond Sutra/ Wisdom for Life Books (English) True Happiness True Freedom True Wisdom Awards 1998 Kyobo Environmental Education Award, Korea 2000 Manhae Propagation Award, Korea 2002 Ramon Magsaysay Peace and International Understanding Award, Philippines 2006 DMZ (Demilitarized Zone) Peace Prize, Gangwon Province, Korea. 2007 National Reconciliation and Cooperation Award, Korean Council for Reconciliation and Cooperation, Korea 2011 POSCO Chungam Award, POSCO Chungam Foundation 2011 Reunification and Culture Award, Reunification and Culture Research Institute, Segye Daily

1585-16 Seocho3-Dong, Seocho-Gu, Seoul, Korea

Lotus Lantern Int'l Buddhist Center

Located in Sokyok-dong, Chongno-gu, the center offers Buddhism in English on Saturday at 5:30-7:00 p.m., Meditation on Thursdays at 7-8:30 p.m., and Sutra Class on Friday

Located in Sokyok-dong, Chongno-gu, the center offers Buddhism in English on Saturday at 5:30-7:00 p.m., Meditation on Thursdays at 7-8:30 p.m., and Sutra Class on Friday

| Islam |

Seoul Central Masjid

Juma Prayers in the Korean, Arabic and English languages at 1 p.m. Fridays. Weekdays five times daily - one hour and 20 minutes before sunrise, at 1 and 4 p.m., at sunset and one and a half hours after sunset - at the mosque in Hannam-dong, Yongsan.

Juma Prayers in the Korean, Arabic and English languages at 1 p.m. Fridays. Weekdays five times daily - one hour and 20 minutes before sunrise, at 1 and 4 p.m., at sunset and one and a half hours after sunset - at the mosque in Hannam-dong, Yongsan.

| Others |

Jehovah's Witnesses Seoul English Congregation

Meetings on Friday at 7:30 - 9:15 p.m. and Sunday at 2-3:45 p.m. The Kingdom Hall is on the fifth floor of the Hannam Building above the International Clinic across Cheil Communications building.

Meetings on Friday at 7:30 - 9:15 p.m. and Sunday at 2-3:45 p.m. The Kingdom Hall is on the fifth floor of the Hannam Building above the International Clinic across Cheil Communications building.

Hinduism: ISKCON Seoul temple

Darshan daily 7 p.m. to 8 p.m. Aarti & kirtan, Sunday 2 p.m. to 8p.m. Bhagavd Gita classes in English, Hindhi, Korean followed by Maha Prasadam at Haebongchon (near Itaewon),

Pope Francis: 'Curse my mother, expect a punch' - BBC News

www.bbc.com/news/av/world-europe.../pope-francis-curse-my-mother-expect-a-punc...

Making a point about freedom of expression, Pope Francis tells journalists on the papal plane that his assistant could expect a punch if he ''cursed his mother''. ... ''Pope Francis: 'I'll PUNCH anyone who insults my mother' - Mirror Online

www.mirror.co.uk › News › World news › Pope Francis I

Jan 15, 2015 - Pope Francis: 'I'll PUNCH anyone who insults my mother' ... “If anything should happen to me, I have told the Lord, I ask you only to give me the ...Charlie Hebdo: Pope Francis says if you swear at my mother – or ...

www.independent.co.uk › News › World › Europe

Jan 15, 2015 - Pope Francis has said there are limits to the freedom of expression - and that anyone who swears at his mother deserves a punch.

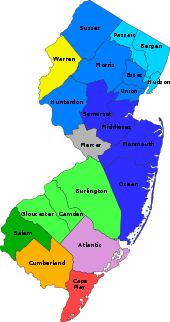

New Jersey is one of the most ethnically and religiously diverse states in the country. As of 2011, 56.4% of New Jersey's children under the age of one belonged to racial or ethnic minority groups, meaning that they had at least one parent who was not non-Hispanic white.[79] It has the second largest Jewish population by percentage (after New York);[80] the second largest Muslim population by percentage (after Michigan); the largest population of Peruvian Americans in the United States; the largest population of Cubans outside of Florida; the third highest Asian population by percentage; and the third highest Italian population by percentage, according to the 2000 Census. African Americans, Hispanics (Puerto Ricans and Dominicans), West Indians, Arabs, and Brazilian and Portuguese Americans are also high in number. New Jersey has the third highest Asian Indian population of any state by absolute numbers and the highest by percentage,[81][82][83][84]with Bergen County home to America's largest Malayali community.[85] Overall, New Jersey has the third largest Korean population, with Bergen County home to the highest Korean concentration per capita of any U.S. county[86] (6.9% in 2011). New Jersey also has the fourth largest Filipino population, and fourth largest Chinese population, per the 2010 U.S. Census. The five largest ethnic groups in 2000 were: Italian (17.9%), Irish (15.9%), African (13.6%), German (12.6%), Polish (6.9%).

Newark was the fourth poorest of U.S. cities with over 250,000 residents in 2008,[87] but New Jersey as a whole had the second-highest median household income as of 2014.[21] This is largely because so much of New Jersey consists of suburbs, most of them affluent, of New York City and Philadelphia. New Jersey is also the most densely populated state, and the only state that has had every one of its counties deemed "urban" as defined by the Census Bureau's Combined Statistical Area.[88]

In 2010, 6.2% of its population was reported as under age 5, 23.5% under 18, and 13.5% were 65 or older; and females made up approximately 51.3% of the population.[94]

A study by the Pew Research Center found that in 2013, New Jersey was the only U.S. state in which immigrants born in India constituted the largest foreign-born nationality, representing roughly 10% of all foreign-born residents in the state.[93]

For further information on various ethnic groups and neighborhoods prominently featured within New Jersey, see the following articles:

- Indians in the New York City metropolitan region

- Chinese in the New York City metropolitan region

- List of U.S. cities with significant Korean American populations

- Filipinos in the New York City metropolitan region

- Filipinos in New Jersey

- Russians in the New York City metropolitan region

- Bergen County#Community diversity

- Jersey City#Community diversity

- India Square in Jersey City, home to the highest concentration of Asian Indians in the Western Hemisphere

- Ironbound, a Portuguese and Brazilian enclave in Newark

- Five Corners, a Filipino enclave in Jersey City

- Havana on the Hudson, a Cuban enclave in Hudson County

- Koreatown, Fort Lee, a Korean enclave in southeast Bergen County

- Koreatown, Palisades Park, also a Korean enclave in southeast Bergen County

- Little Bangladesh, a Bangladeshi enclave in Paterson

- Little Istanbul, also known as Little Ramallah, a Middle Eastern enclave in Paterson

- Little Lima, a Peruvian enclave in Paterson

******

**********

*http://www.marutv.com/video/%EB%8B%A4%ED%81%90-%ED%94%8C%EB%9F%AC%EC%8A%A4-36%ED%9A%8C-11-11-2018/?tape=3

*http://www.marutv.com/video/%EB%8B%A4%ED%81%90-%ED%94%8C%EB%9F%AC%EC%8A%A4-36%ED%9A%8C-11-11-2018/?tape=3

Beverage Industry Pioneer And Holocaust Survivor Langer Passes Away

Mr. Nathan Langer

Mr. Nathan Langer, founder and president of Langer Juice Co., died Wednesday following complications from a stroke.

Mr. Langer founded Langer Juice Co. in 1960 and co-founded Unadulterated Foods (later known as Snapple) in 1973. He also was a Holocaust survivor.

Mr. Langer, a native of Krakow, Poland, grew up in a family of wine makers, where he learned the craft of making high-quality and pure beverages at Arade Winery, the family winery. Following the Nazi occupation of Poland in 1939, Arade was confiscated, and Mr. Langer and his parents and sister were taken to concentration camps. Mr. Langer and his father were sent to Skarzysko-Kamienna forced labor camp; he did not leave as long as his father was there; he escaped once that he saw his father had no longer survived.

Mr. Langer also survived the Nazi bombing of his aunt’s apartment building in Warsaw where he, his sister and aunt were in hiding. He was able to dig out and save his aunt, but he could not save his sister. Mr. Langer was his immediate family’s only survivor.

In 1945, Mr. Langer went to the American Sector of Berlin to emigrate to the U.S. He arrived in the U.S. in 1949. While in Berlin, he met his wife of 60 years, Mira, also a Holocaust survivor, who preceded him in death.

Mr. Langer founded Langer Juice Co. with the aspiration of making juice with the care and purity he learned at the family winery. He created juices that were made with locally grown fruit and without preservatives or other additives, and the company grew from a local, Southern California brand in health food stores to a national brand that is one of the largest, family-owned juice companies. In 1973, Mr. Langer and three partners founded another company, Unadulterated Foods, based on the same principles of quality and purity, the predecessor of the Snapple brand.

Mr. Langer frequently told his children and grandchildren that his story was the personification of the American Dream and proved that an immigrant who came to the U.S. without speaking English and without financial resources has the opportunity to build a business, raise a family, educate his children and start a new life in America, where he proudly became a U.S. citizen.

Mr. Langer is survived by three sons, Dennis Langer, M.D., a former pharmaceutical executive and co-founder/director of several bio-pharmaceutical companies; David and Bruce Langer, co-VPs of Langer Juice Co.; daughters-in-law, Susan Langer, M.D., Melissa and Stefani; and seven grandchildren and a great-grandson.

Funeral services for Mr. Langer will be held at 2:30 p.m. Sunday, June 7, at Harbor Lawn-Mt. Olive Memorial Park & Mortuary, 1625 Gisler Avenue, in Costa Mesa, California.

A meal of consolation will follow at 5 p.m. at Mimi’s Cafe, 1835 F. Newport Boulevard in Costa Mesa.Nathan Langer, who survived the Holocaust and went on to found Langer Juice Co., died Wednesday at the age of 86.

A native of Krakow, Poland, Langer escaped from a concentration camp when he was a young boy after his father was killed. He and a sister later hid at his aunt’s apartment in Warsaw until her building was bombed by the Nazis, killing his sister. He was the only survivor of his immediate family.

After World War II, Langer immigrated to the United States, along with his wife, Mira, another Holocaust survivor.

In 1960, he founded the City of Industry juice company, continuing in the beverage business he’s learned as a boy at his family’s company, Arade Winery. Langer was also a co-founder of Unadulterated Food Products, which later became Snapple, according to his son, Bruce. He and another of Langer’s three sons, David, are now vice presidents at Langer Juice Co. A third, Dennis, is a physician.

“Our father would always say, ‘How you make your bed is how you are going to sleep,’” Bruce Langer said. “He always believed in being prepared, organized, on time, if not always early, for meetings, and especially he believed in hard work.” http://www.theshelbyreport.com/2015/06/05/beverage-industry-pioneer-and-holocaust-survivor-langer-passes-away/